Now Reading: How AI-Powered Modeling Software Builds a Bank’s Digital System in Minutes

-

01

How AI-Powered Modeling Software Builds a Bank’s Digital System in Minutes

How AI-Powered Modeling Software Builds a Bank’s Digital System in Minutes

How AI-Powered Modeling Software Builds a Bank’s Digital System in Minutes

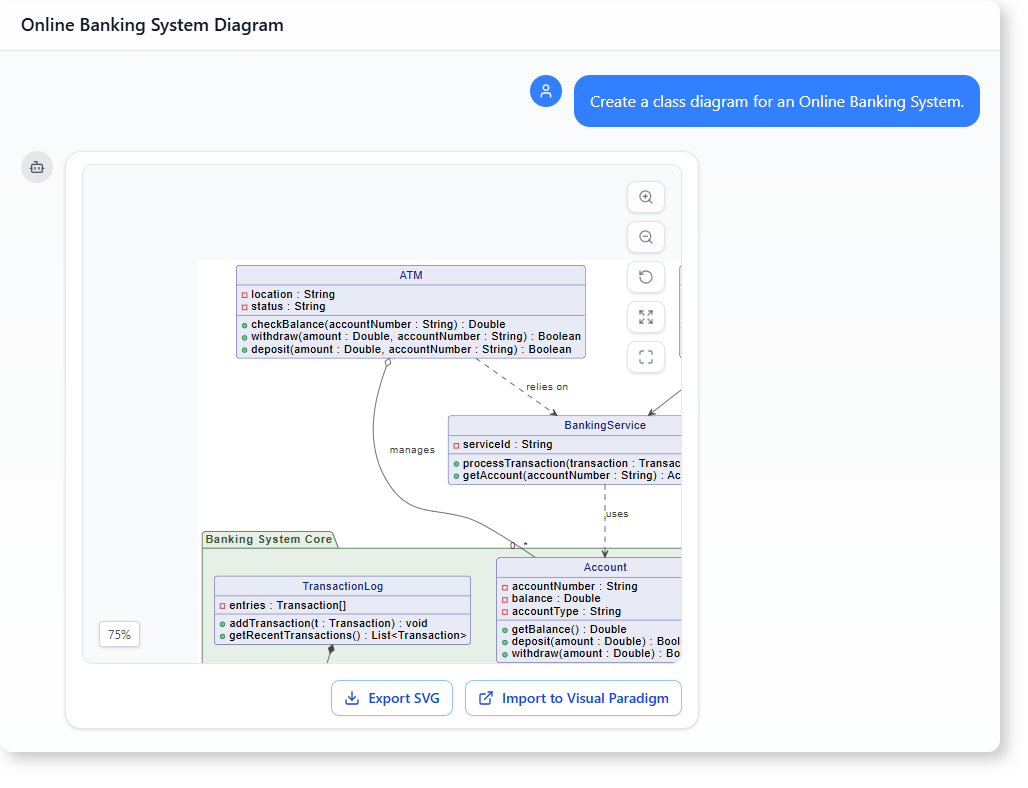

Imagine a software team needing to design an online banking system. They don’t start with code. They start with a clear picture — a class diagram that shows how accounts, transactions, and customers relate.

This is where AI-powered modeling software steps in. Instead of manually drawing connections or sifting through documentation, teams can describe their system in plain language, and the AI generates a structured, accurate diagram.

The result? A clear map of the system’s components — showing hierarchy, associations, and dependencies — all within minutes.

Why This Matters for Real-World Projects

A well-structured class diagram is more than just a visual. It serves as a shared language between developers, product owners, and analysts. In a banking context, clarity around account types, transaction flow, and service dependencies is critical.

Without proper modeling, teams risk inconsistencies, duplicated logic, or missing features. AI-powered modeling software fills that gap by turning natural language prompts into precise, structured diagrams.

A Real-World User Journey: From Prompt to Diagram

Let’s follow a developer’s journey using an AI-powered modeling tool.

Background:

The developer is part of a fintech team building a new online banking platform. The team needs to understand how different components interact — especially between customer accounts, transactions, and bank services.

Objective:

They need a class diagram that clearly shows:

- The hierarchy of account types (savings, checking)

- How transactions and logs are managed

- How ATM and banking services connect to accounts

They don’t have time to build the diagram manually or rely on outdated templates.

Steps Taken:

- The user opened the AI-powered modeling interface and typed:

Create a class diagram for an Online Banking System.

The AI interpreted the request, identified key components, and began constructing a model based on common banking patterns.

- After generating the initial structure, the user reviewed the diagram and asked:

Provide an overview of the hierarchy and associations represented in the diagram.

The AI responded with a clear breakdown of the system’s organization, including inheritance, composition, and dependency relationships.

- The resulting diagram showed a clean architecture with:

Accountas the base class, extended bySavingsAccountandCheckingAccountTransactionlinked toAccountand stored inTransactionLogATMmanaging multiple accounts and relying on theBankingServiceCustomerhaving one account and using banking services directly

- The AI also highlighted the relationships:

- Inheritance: Savings and Checking accounts inherit from Account

- Composition: TransactionLog holds multiple Transaction objects

- Aggregation: ATM manages many accounts

- Dependencies: BankingService uses Account, ATM depends on BankingService

What the User Gets:

- A complete class diagram with proper hierarchy and associations

- Clear visual flow showing how components interact

- Real-world context: all elements represent actual banking operations

- Immediate clarity on system structure without needing prior modeling knowledge

Key Features That Make This AI Modeling Tool Effective

The tool doesn’t just generate diagrams. It understands the domain.

- It recognizes that an online banking system needs core entities like accounts, customers, and transactions

- It applies real-world rules: savings and checking accounts are types of accounts

- It identifies natural relationships: a transaction is linked to an account, logs store transactions

- It shows dependencies between services, like ATM relying on banking logic

This is not just a diagram. It’s a working blueprint.

Comparison of Modeling Approaches

| Approach | Time | Accuracy | Requires Expertise |

|——–|——|———|———————|

| Manual drawing | Hours | Variable | High |

| Template-based | Minutes | Limited | Medium |

| AI-Powered Modeling | Minutes | High | Low |

AI-powered modeling software removes guesswork. It doesn’t assume. It learns from context and delivers relevant, accurate structures.

Why This Is a Step Forward for Banking Systems

In banking, every component must be traceable and reliable. An AI-powered modeling tool helps engineers see the big picture without getting lost in detail.

It enables faster design reviews, reduces errors in requirement gathering, and supports team alignment.

Is This the Future of Software Design?

Not just a future. A present reality.

Teams that use AI-powered modeling software don’t need to be UML experts. They just need to explain what their system does.

This shifts design from being a technical chore to being a collaborative conversation.

FAQs

Q: Can AI generate a class diagram for a banking system?

A: Yes. By describing the system in simple terms — like ‘an online banking system with savings and checking accounts’ — the AI builds a class diagram that includes hierarchy, associations, and relationships.

Q: What does the AI show in the diagram?

A: It shows clear relationships: inheritance between account types, composition between logs and transactions, and dependencies between services like ATM and BankingService.

Q: How does the AI understand banking logic?

A: It uses domain knowledge patterns. When you describe a banking system, it applies known structures — like account hierarchies, transaction logs, and service dependencies — to build a realistic and functional diagram.

Q: Is this tool useful for non-technical stakeholders?

A: Absolutely. The AI turns natural language descriptions into visual models that anyone can understand — from product managers to business analysts.

Ready to map out your system’s interactions? Give our AI-powered modeling software a try at Visual Paradigm’s AI Chatbot today!