Visual Paradigm Desktop |

Visual Paradigm Desktop |  Visual Paradigm Online

Visual Paradigm OnlineA financial institution doesn’t operate in a vacuum. It’s shaped by the world around it—by laws, by economic shifts, by what people want, and by how technology evolves.

For a bank, understanding these external forces is essential. That’s where a PEST Analysis comes in. It breaks down the external environment into four key areas: Political, Economic, Social, and Technological.

Instead of manually compiling data or guessing trends, modern professionals are turning to AI-powered modeling software to generate accurate, structured, and actionable insights. This approach saves time, reduces bias, and ensures clarity.

This example follows a real user who works in strategy for a mid-sized banking institution. Their goal was to understand the current external pressures facing their organization—especially in the wake of rising regulatory scrutiny and shifting customer expectations.

They didn’t start with a diagram. They started with a single question: How can I assess the external environment affecting our banking operations?

Their first step was to ask the AI-powered modeling software:

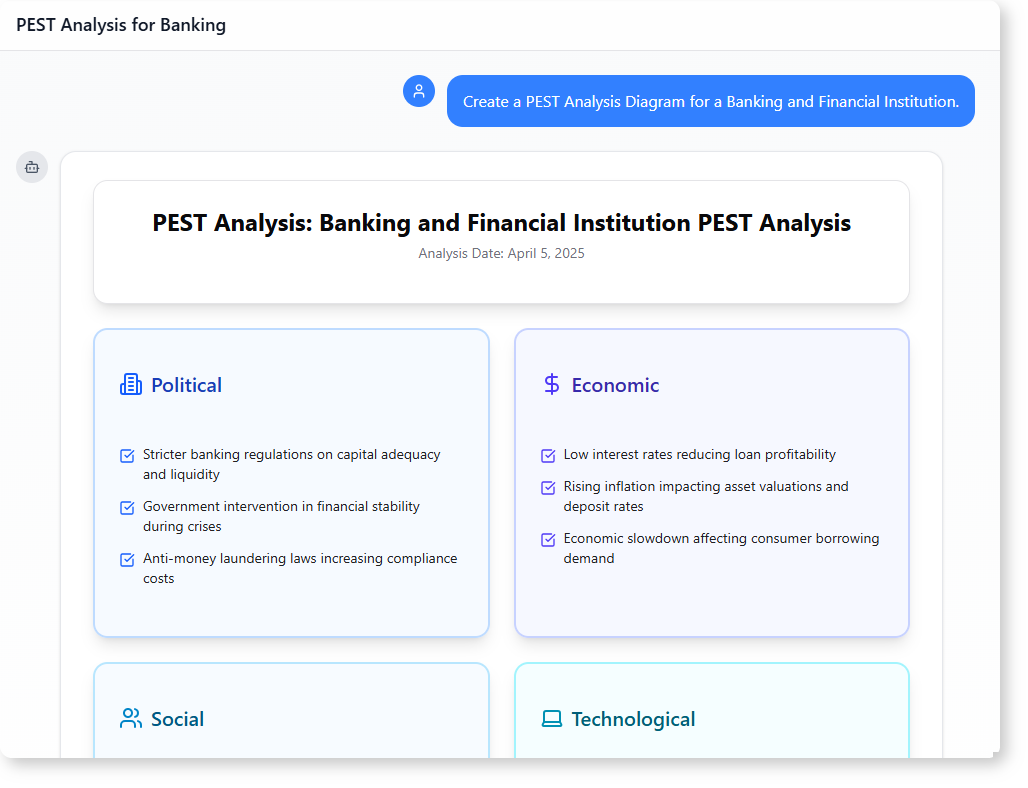

Create a PEST Analysis Diagram for a Banking and Financial Institution.

The system responded instantly with a clear, visual PEST Analysis organized by the four categories. The diagram wasn’t just a placeholder—it included specific, relevant factors tied to each domain.

Once the diagram was generated, the user realized they needed more than a visual. They needed a written breakdown that explained the implications. So they followed up with:

Turn this PEST Analysis Diagram into a structured written analysis with detailed insights.

The AI transformed the diagram into a detailed report that explained not only what was happening, but why it mattered.

The output wasn’t just a list. It provided thoughtful, context-aware observations that mirror real-world challenges:

These points reveal that regulatory risk is a long-term pressure. The institution must plan for increased compliance budgets and operational complexity.

This shows a clear financial strain. The bank may see lower loan yields, which could affect profitability. It also indicates a drop in consumer confidence—something that directly impacts loan demand.

These points highlight a cultural shift. Customers now expect convenience and transparency. The bank must adapt its services—either through better UX or by offering educational tools.

Technology is not just a trend—it’s now a core component of operations. The bank must either adopt these tools or risk falling behind in security and customer trust.

Traditional PEST Analysis tools often rely on static templates, manual research, or incomplete data. The AI-powered modeling software doesn’t just generate a diagram—it understands context and delivers insight.

It turns a simple request into a strategic foundation. The user doesn’t need to spend hours researching or compiling data. The AI builds a coherent, well-structured analysis based on current trends and industry patterns.

This isn’t just a PEST diagram tool. It’s an intelligent assistant that helps professionals make decisions grounded in real-world dynamics.

Whether you’re in banking, finance, or any sector facing external change, a clear PEST Analysis is critical. With AI-powered modeling software, you can:

The tool doesn’t replace human judgment. It simplifies the process and gives the user a foundation to build on.

A PEST Analysis evaluates the political, economic, social, and technological forces affecting an organization. It helps leaders anticipate risks and opportunities before they become urgent.

Yes. With AI-powered modeling software, users can generate a detailed PEST Analysis for banking and financial institutions in minutes—without needing deep research or prior knowledge.

Absolutely. The output is not just descriptive—it’s actionable. It provides clear insights that can inform product development, risk management, and customer strategy.

Basic tools offer templates. This AI-powered modeling software understands context, generates relevant factors, and turns them into structured, insightful reports—making it far more practical for real-world decision-making.

Ready to map out your system’s interactions? Give our AI-powered modeling software a try at Visual Paradigm’s AI Chatbot today!.